Searching for a straightforward path to owning a home in Western Australia? Keystart home loans provide low deposit options and no LMI to make homeownership attainable. In this article, we’ll detail how Keystart works, who qualifies, and practical insights for potential borrowers.

Key Takeaways

- Keystart Home Loans offers low deposit options starting at 2% or $2,000, has waived LMI costs, and helps Western Australians faster access home ownership with benefits tailored for low to moderate income earners.

- Eligibility for a Keystart loan includes being a Western Australian resident, living in the home during the loan term, and not owning another property at the time of application, with income and property price caps varying by region.

- While Keystart’s interest rates might be slightly higher, they’re offset by significant benefits like low deposit requirements, no LMI, and special considerations for FIFO workers.

Understanding Keystart Home Loans

Keystart Home Loans is like the fairy godmother of the home loan market in Western Australia. It’s a low deposit finance option specifically designed to assist residents in achieving home ownership. The magic lies in their ability to facilitate faster access to home ownership by reducing entry costs and eliminating monthly account fees. Since its establishment, Keystart has waved its magic wand for close to 120,000 Western Australians, helping them step onto the property ladder.

But there’s one key rule with Keystart loans. They’re for owner-occupiers. That means you must reside in the home during the loan term and not own another home or land at settlement. It’s all about helping people to live in their own homes, not to build property empires.

Low Deposit Requirement

One of the key benefits of Keystart loans is the low deposit requirement. In the world of home loans, the size of the deposit can often be a stumbling block on the home building journey. But with Keystart, you can begin your journey to home ownership with a deposit starting from just 2% or $2,000, whichever is higher. This low deposit requirement makes the dream of owning a home achievable sooner.

Keystart offers the following benefits for low deposit home loans:

- They assist applicants by determining the maximum borrowing amount based on their capacity to service the home loan.

- If you’re constructing a new home, you can even use your First Home Owner Grant towards the deposit.

- It’s like getting a boost on your journey to your new home.

No Lender’s Mortgage Insurance (LMI)

Another advantage of Keystart loans is that they don’t require borrowers to pay Lender’s Mortgage Insurance (LMI). In the traditional loan landscape, if your deposit is less than 20%, you’re usually hit with LMI costs. Not with Keystart.

By not charging LMI, Keystart reduces upfront costs significantly for borrowers, making the dream of owning a home faster and more affordable. It’s like getting a pass on one of the least favourite parts of the home loan process.

Eligibility Criteria for Keystart Loans

So, you might be wondering, “What’s the catch?” Well, like any loan, Keystart loans have certain eligibility criteria. The good news is that these criteria are designed to be inclusive, accommodating a wide range of income levels and targeting those who may not meet mainstream deposit requirements.

Applicants must be Western Australian residents and must not own another home or land at the time of settlement. But don’t worry if your credit rating is less than perfect. Keystart has easier criteria in place for those with a poor credit rating, including past defaults or bankruptcy. They also don’t require a saving history, so if you’ve struggled to save but have a steady income, Keystart could be the key to your new home.

Income Limits

Keystart loans are designed to cater to singles, couples, and families, with income limits adjusted to accommodate these different applicant types. The specific income limits depend on the location of the home purchase or construction.

For singles in the Perth Metropolitan area, the income limit is capped at $105,000, while for couples it’s $130,000 and for families it’s $155,000. If you’re in a regional area excluding Kimberley & Pilbara, the income limits are $125,000 for singles, $130,000 for couples, and $155,000 for families. For those in the Kimberley and Pilbara regions, the income limits are even higher.

Property Price Caps

Now, let’s talk about property price caps. Just like the income limits, Keystart home loans have specific property price caps that determine the maximum purchase price for eligibility.

For purchases in the Perth Metropolitan area, the property price cap is $560,000. The same cap applies to regional Western Australia, excluding Kimberley and Pilbara. These new property price caps were implemented effective from December 12, 2022.

Interest Rates and Loan Terms

Let’s dive into the nitty-gritty of interest rates and loan terms. Keystart’s standard variable interest rates vary depending on when your loan commenced. But don’t fret, they’ve aligned their interest rate policy with the Reserve Bank of Australia’s cash rate, which came into effect from 1 July 2023.

While Keystart’s offers slightly higher interest rates compared to traditional banks, they offset this with their unique benefits:

- Low deposit requirement

- No LMI (Lenders Mortgage Insurance)

- Transparency in interest rate calculations

- Help customers compare loan costs through a Key Facts Sheet

These features make home ownership more accessible for many people, especially with the availability of home buyers grant funds, helping them get home sooner.

Special Considerations for FIFO Workers

Keystart doesn’t just cater to the typical home buyer. In addition, they have announced exciting changes to their policies for FIFO (Fly-In-Fly-Out) workers. These changes are set to bring positive impact for many employees..

These policy changes could significantly benefit FIFO workers, especially those earning overtime. They provide an opportunity for FIFO workers to obtain a home loan and enter the property market. To understand how these policy changes affect them, FIFO workers are encouraged to get in touch with Keystart’s partners, like Resolve Finance, for further information.

Comparing Keystart Loans with Other Low Deposit Options

Now, it’s time to put Keystart loans under the microscope and see how they stack up against other low deposit home loan options. Keystart loans have unique advantages, but they may also come with challenges and limitations.

Some customers have expressed frustration with Keystart’s shared-equity program, especially when they’ve found themselves unable to sell or renegotiate terms during market slumps. Some restrictions, such as not being able to rent out the property or own a second home, have garnered mixed reviews.

Advantages of Keystart Loans

Despite these challenges, Keystart loans offer some significant advantages. The low deposit requirement is a big plus, making home ownership accessible to many who might not otherwise qualify for a traditional home loan.

In addition, Keystart offers a shared ownership home loan option where borrowers can co-own property with Western Australia’s Housing Authority for up to 30%. This means you can start with a smaller stake and increase your property share over time.

Alternative Low Deposit Home Loans

Of course, Keystart isn’t the only game in town when it comes to low deposit home loans. Other options include the Urban Connect Home Loan and some lenders offering a mere 2% deposit requirement.

Each of these alternatives comes with its own set of pros and cons. While some may offer higher income limits, they may also charge LMI for smaller deposits. It’s essential to consider the trade-off between saving for a larger deposit to access a broader range of lending options with lower entry costs and the opportunity cost of continuing to rent.

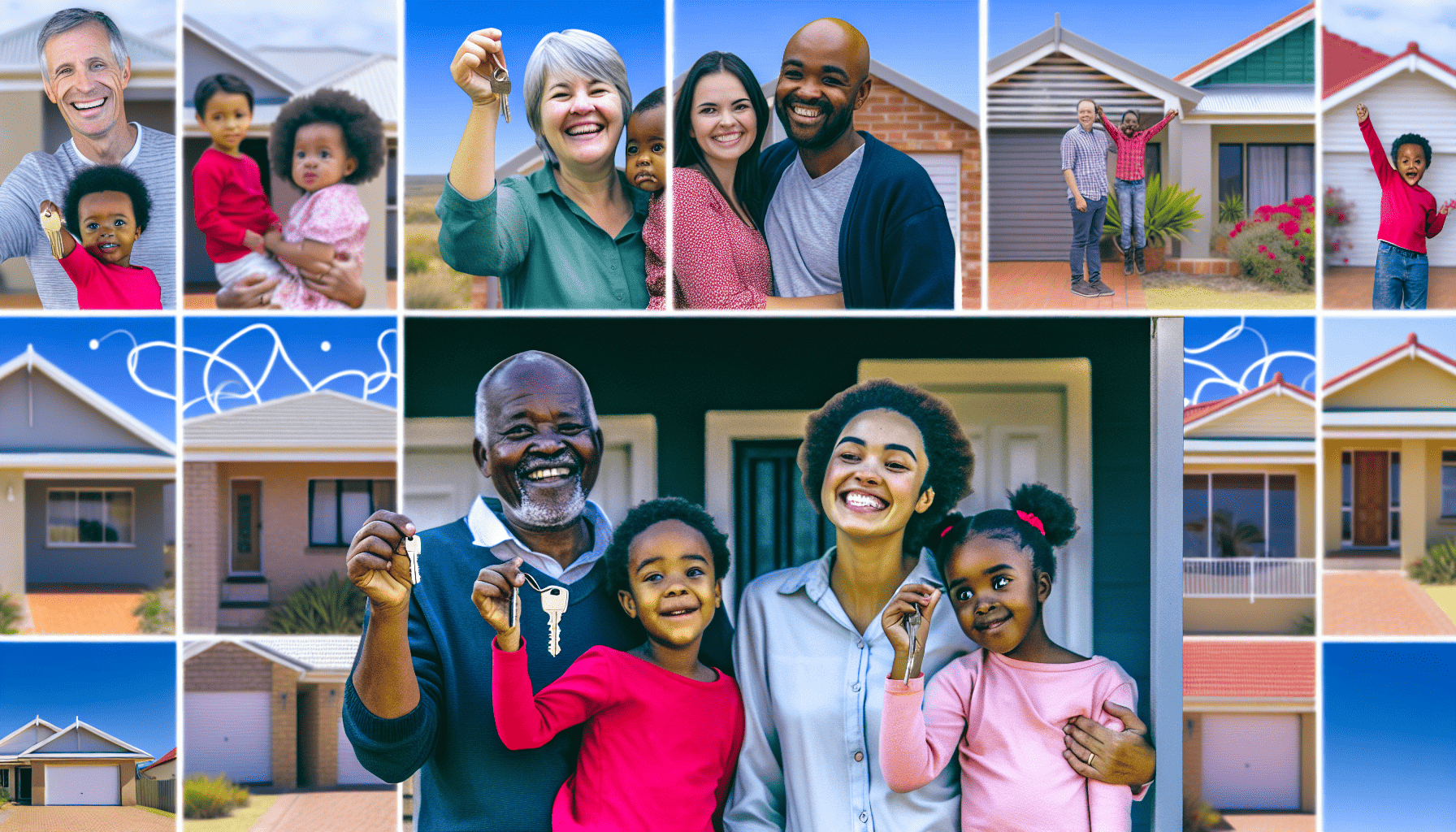

Real-Life Success Stories: Keystart Home Loan Recipients

Nothing speaks louder than real-life success stories. Let’s take Mervyn and Cathryn from Broome. They were the first to achieve home ownership through the Jalbi Jiya program and Keystart, showcasing the effectiveness of this partnership.

Not only did Mervyn and Cathryn praise Keystart for the supportive team and the straightforward loan process but they also emphasized the importance of home ownership in strengthening their family bonds and creating a stable environment for their children and grandchildren. Mervyn voiced a hope for more widespread home ownership opportunities within his community, recognising the attainability that the Keystart and Jalbi Jiya programs provide.

Tips for Maximising Your Keystart Home Loan Experience

So, you’re considering a Keystart home loan? Here are some tips to maximise your Keystart experience:

- It’s all about savings. Separate your ‘wants’ from your ‘needs’.

- Create different savings accounts for various purposes.

- Set up visual reminders for motivation.

Next, make the most of the Keystart App and Client Portal to manage your loan effectively. You can check your loan balance, interest rate, and even make additional payments. And remember, Keystart offers free financial coaching services. So, take advantage and get the guidance you need throughout the home loan process.

What is the income limit for Keystart?

A common question about Keystart loans is about keystart income limits. The income limit for Keystart loans depends on the location of the property and the applicant’s family status.

For the Metropolitan area, the income limits are $105,000 for singles, $130,000 for couples, and $155,000 for families. In Regional Areas excluding Kimberley & Pilbara, the income limits are $125,000 for singles, $130,000 for couples, and $155,000 for families. The income limits are even higher for the Kimberley and Pilbara regions.

Is Keystart only for first home buyers?

Another common question about Keystart is whether it’s only for first home buyers. The answer is no. Keystart loans are not exclusively for first home buyers. They’re aimed at owner-occupiers intending to live in the home for the duration of the loan.

This means that even if you’ve owned a home before, you could potentially qualify for a Keystart loan if you don’t own another home or land at the time of application and settlement. Keystart loans are designed to assist various types of borrowers, including singles, couples, and families, provided they fall within the set income limits.

Keystart FAQ’s

To wrap up, let’s go through some frequently asked questions about Keystart loans. These FAQs address common questions about interest rates, eligibility, deposits, and more.

These questions include:

- “What is the current Keystart interest rate?”

- “Do you need a deposit with Keystart?”

- “Is Keystart only for first home buyers?”

- “Can you rent out a Keystart home?”

- “Who is eligible for home start loan?”

Summary

In conclusion, Keystart home loans offer a unique opportunity for Western Australians to achieve home ownership. With their low deposit requirement, no LMI, and inclusive eligibility criteria, Keystart can be the key to unlock your home ownership dreams. Whether you’re a first home buyer or looking to return to the property market, Keystart could be your ticket to a home of your own.

Frequently Asked Questions

Can you get a Keystart loan on Centrelink?

No, if Centrelink is your only source of income, you are unlikely to be approved for a Keystart loan. They do accept some Centrelink benefits as income, but your total income will affect the amount you can borrow.

Is Keystart only for first home buyers?

No, Keystart loans aren’t just for first home buyers. They are also available to others who meet the minimum eligibility requirements. So, if you’re not a first home buyer, you can still qualify for a Keystart loan.

Do you need a deposit with Keystart?

Yes, with Keystart, you only need a deposit as low as 2%, which can help you get into your own home sooner. This deposit doesn’t necessarily need to be genuine savings, making it more accessible.

What is the current Keystart interest rate?

The current Keystart interest rate is 7.85% per annum, effective from 24 November 2023.

What is the income limit for Keystart?

The income limit for Keystart now stands at $105,000 for singles and $130,000 for couples. (Answer based on Answer 1)